Article Contents:

Excess cash: priority for business head:

As a small business owner, you wear many hats—managing operations, serving customers, leading employees, and juggling relationships with suppliers and banks.

With all these responsibilities, it’s easy to lose sight of one simple fact: the core purpose of your business is to generate excess cash.

Why?

When your business has more cash than it needs, everyone benefits—your employees, customers, suppliers, bank, and even you as the promoter.

Let’s explore why excess cash is critical and how it meets the needs of your key stakeholders.

Business stakeholders and their expectation from business:

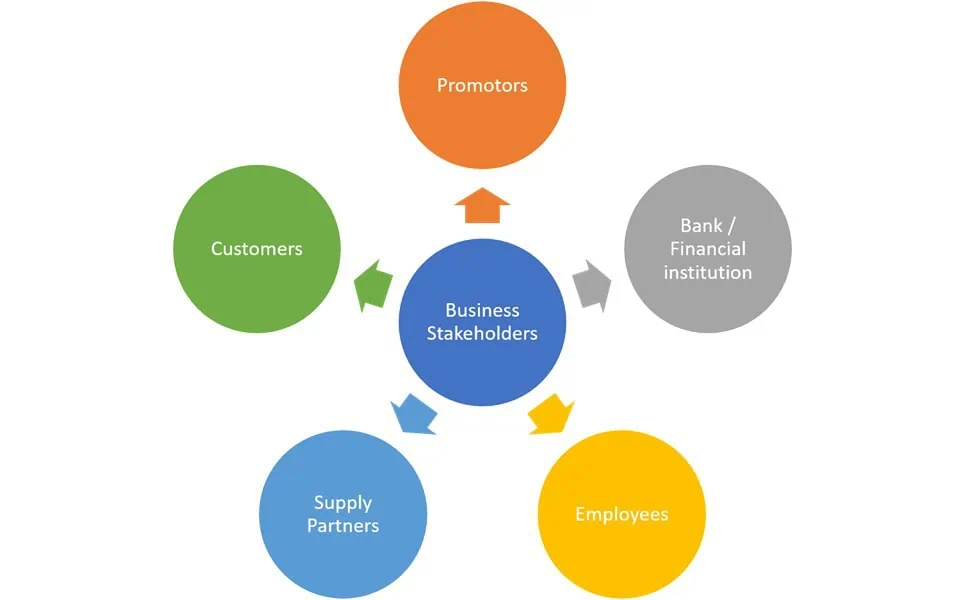

The picture shows that business stakeholders include banks, shareholders, customers, supply partners, and employees.

Each stakeholder has different expectations or needs from the business.

The organization’s purpose is to fulfill the stakeholder’s expectations or needs.

Let us understand what each stakeholder expects from the business.

- Bank / Financial Institution

Banks and other financial institutions are vital stakeholders when it comes to financing. They want to know that your business is financially stable and can repay loans. Promoter (You!)

As a business owner or promoter, your primary goal is to see your business thrive while ensuring personal financial security.Employees

Employees are the backbone of your business, and their expectations or needs revolve around job security, timely pay, and growth opportunities.Customers

Customers want reliable service or products, consistency, and confidence that your business will be around long-term to support their needs.Suppliers

Suppliers play a crucial role in maintaining your supply chain. They value businesses that pay on time and can scale their orders as needed.

How excess cash serves everyone?

Focusing on generating excess cash is about ensuring your business remains liquid, stable, and poised for growth. When cash flow is healthy, every stakeholder’s needs are met:

- Banks/ financial institutions see a low-risk borrower, giving you better loan options.

How does Excess Cash serve the bank / Financial institutions?

Excess cash ensures you can timely service debt and reduce the default risk.

It also improves your credibility, making it easier to negotiate better loan terms, such as lower interest rates or higher credit limits when needed.

With healthy cash reserves, you build a solid financial reputation with your bank, opening doors to more favorable financing options in the future.

One of my clients finds it challenging to get a loan for his business despite showing the last 2~3 years’ sales growth and potential business prospects for the future. The bank declined to provide a loan, stating that even though the growth is shown in the book, the company could not get any decent profitability and generate excess cash in the past.

- As the promoter, you have peace of mind and financial flexibility to explore new opportunities.

How does Excess Cash serve YOU as a promotor?

Excess cash gives you peace of mind. You can draw a stable income from the business while reinvesting for growth. It also allows you to explore new opportunities, take calculated risks, and innovate without worrying about covering day-to-day expenses. You can step back from survival mode and focus on scaling the business.

- Employees enjoy job security and timely compensation, leading to higher morale and productivity.

How Does Excess Cash serve Employees’ engagement?

A well-funded business can ensure timely payment of salaries and benefits, which is critical for employee satisfaction and retention. It also enables you to invest in employees’ development, offer bonuses or incentives, and create a positive work environment where employees feel valued and secure in their roles. Happy employees contribute to higher productivity and lower turnover.

In many small organizations, delayed monthly salaries led to poor engagement among people.

- Customers receive reliable service and confidence that your business is here to stay.

How Does Excess Cash Serves Customers?

When you have excess cash, you can invest in improving product quality, delivering better customer service, and expanding your offerings. This gives customers confidence that you can consistently meet their demands. Whether scaling production to meet rising demand or investing in better customer support, cash reserves ensure your business can deliver on its promises.

- Suppliers appreciate prompt payments and can offer better deals, helping improve your margins.

How does Excess Cash serve Supply partners?

Excess cash allows you to negotiate favorable terms with suppliers, such as discounts for early payments or bulk purchases. Cash reserves also ensure you never fall behind on payments, strengthening relationships, and building trust. This can give you leverage to negotiate better terms in the future, helping improve profitability.

How to build Excess cash in the business?

So how do you maintain a steady flow of excess cash? Here are some practical steps:

- Monitor cash flow consistently. Understand where your money is going and where it’s coming from.

- Tracking payables and receivables and following up with clients for collection to some extent helps many negative consequences like borrowing at higher interest rate, premium buying of raw materials etc

- Focus on high-margin products or services that give you the most profit with the least expenditure.

- Negotiate better payment terms with both customers (faster payments) and suppliers (longer terms).

- Control your expenses by eliminating waste in the manufacturing and business processes by implementing holistic lean system thinking as a culture.

- Prioritizing investments that directly drive growth or efficiency.

To Sumup,

In small business, cash truly is king. By generating excess cash, you’re setting yourself up for success—not just in terms of profitability but ensuring every stakeholder is taken care of.

Your bank sees stability, you, as the promoter, enjoy freedom, your employees feel secure, your customers trust you, and your suppliers value your relationship.

Excess cash isn’t just a nice-to-have; it’s the key to running a thriving, sustainable business that benefits everyone involved.

The business head must prioritize as a prime responsibility.