Article Contents:

Understanding the Power of the P&L Statement- a guide for small business CEOs

In the dynamic world of small business, staying on top of financial health is crucial for sustainable growth and success.

One of the most powerful tools at the disposal of a small business CEO is the Profit and Loss (P&L) statement.

For small business CEOs, the P&L statement is not just a financial document—it’s a roadmap to informed decision-making, strategic planning, and operational efficiency.

By regularly analyzing the P&L statement, CEOs can identify trends, uncover inefficiencies, and make data-driven decisions that drive profitability and growth of the business.

However some of the CEO’s feel that they are not from finance background, hence P&L analysis needs to be delegated to financial experts like Auditor or financial consultants.

The truth is that you need to understand the basics of P&L statements even to utilize those financial expert’s service effectively.

Understanding P&L statement is not that much difficult and it can be learnt with some efforts.

In fact some of my clients CEO’s are technocrats and they have learnt the basics of P&L statement within 2~3 months time by analyzing every month. They have benefitted from insights which i have given in case study examples.

In this article, i have given basic idea of P&L statements and how you can use it for understanding more insights about your business and to take right decisions to drive profitability and growth.

Understanding and utilizing this essential financial tool can spell the difference between mere survival and thriving success in the competitive marketplace.

What is meant by P&L Statement?

A Profit and Loss (P&L) statement, also known as an income statement or statement of operations, is a financial report that summarizes the revenues, costs, and expenses incurred by a business during a specific period, typically a monthly, quarterly or yearly.

The main purpose of a P&L statement is to provide a clear picture of a company’s financial performance, showing whether it has made a profit or incurred a loss over that period.

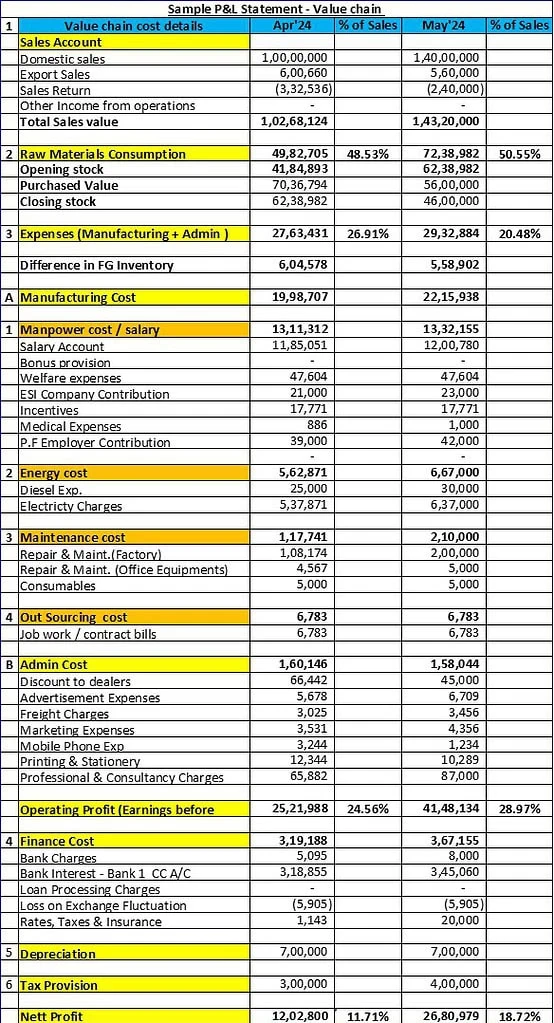

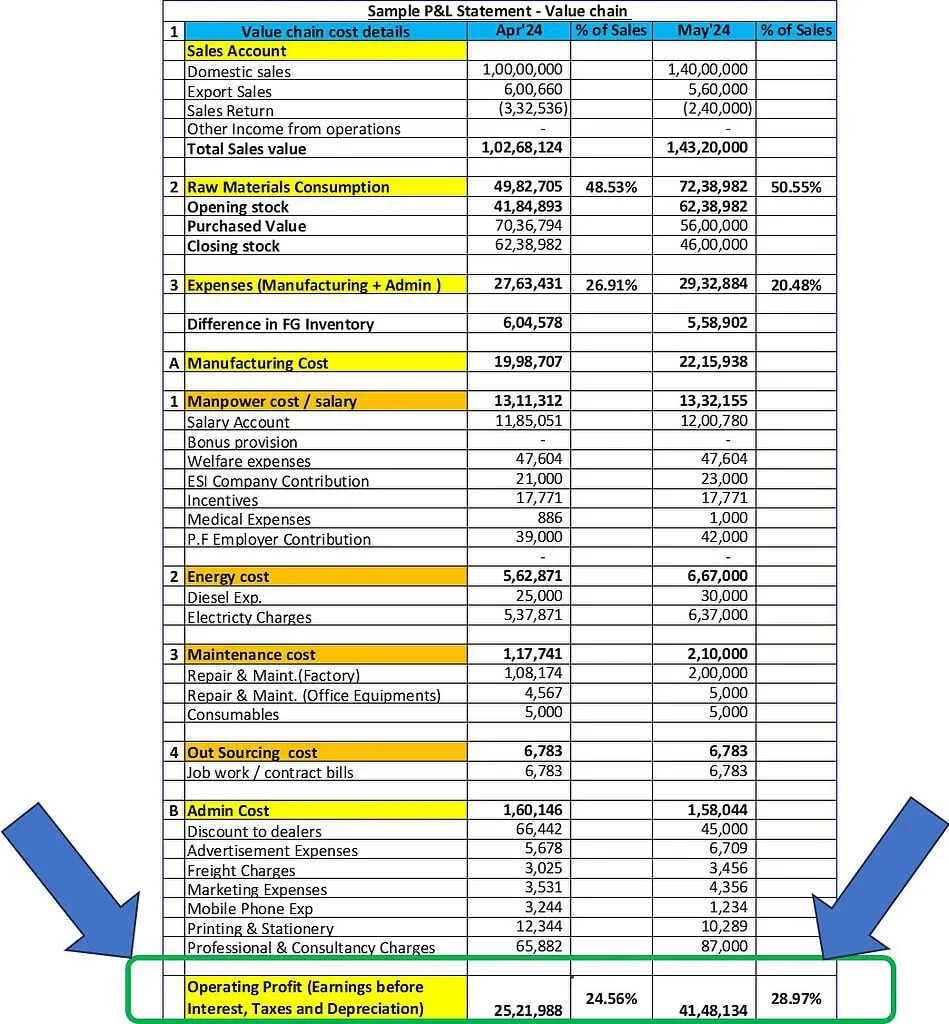

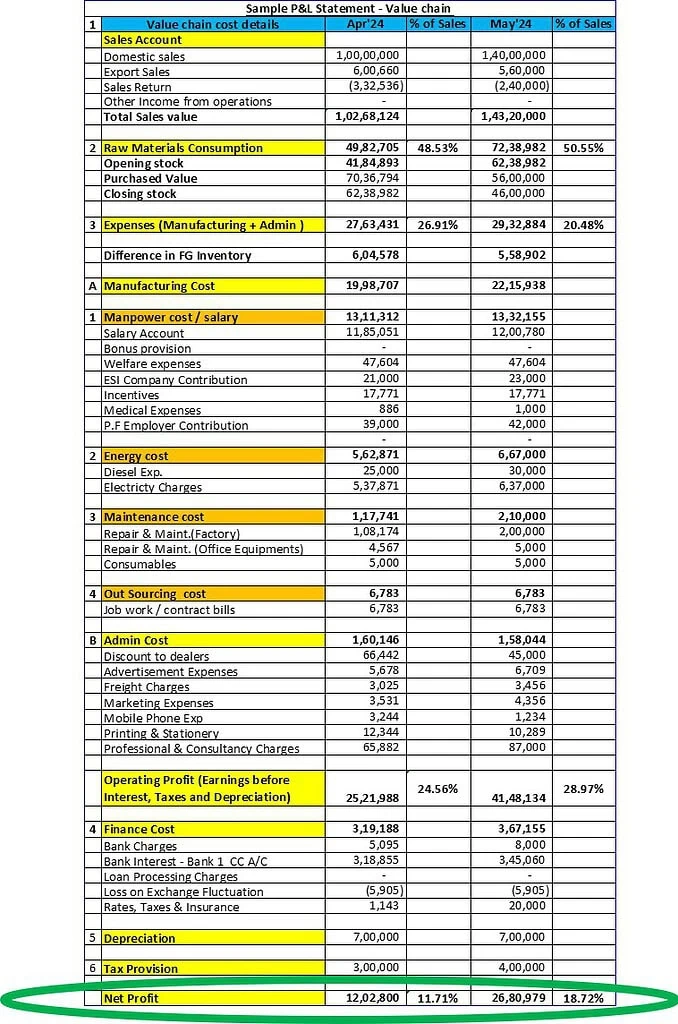

Sample P&L Statement format

Given below the sample P&L format as deigned by me and implemented in some of my client’s organization.

Even though one can get profit and loss statement in accounting software, say in TALLY, this format will have many advantages in terms of its simplicity.

- In this format, it is easy to compare the same cost element month on month.

- Also one can compare every cost element as a % of sales which will give relatable comparison to take right decisions.

Once you understand the concept behind the P&L Construct and how it needs to be interpreted, you can always modify or customize according to your organizational requirements.

Key components of P&L Statement and its implications

There are many ways people make P&L format with different terminologies like COGS( cost of goods sold),EBITDA, OPERATING PROFIT, GROSS PROFIT, NET PROFIT and CONTRIBUTION etc.

However all of them leads to identify whether the business is healthy or not.

Given below the sample format i have developed and used in my clients.

To begin with, i suggest that you can understand the concept of P&L construct and you can use any format / terminology.

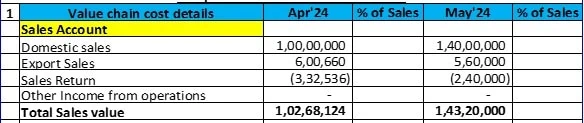

- Revenue Part :

This part includes all the sales or revenue accounting.

You may include Export / Domestic sales , Any sales returns can be deducted under this revenue part.

Sometime, you may get one time revenue other than operations .for eg, dividends income, scrap income etc , you can add under revenue part.

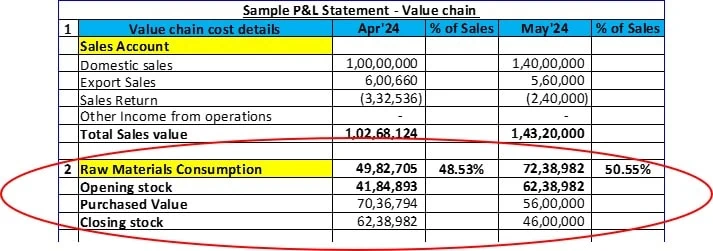

2. Raw Material Consumption:

This part includes RM consumption value as some CEO’s would like to see the RM consumption as % of sales.

This will be arrived from the opening inventory +purchased during the month -closing inventory from store /ERP data.

Tracking RM cost separately will give clarity with reference to sales.

Also once can understand the dynamics of closing / opening stock levels and accordingly can take decisions on purchasing.

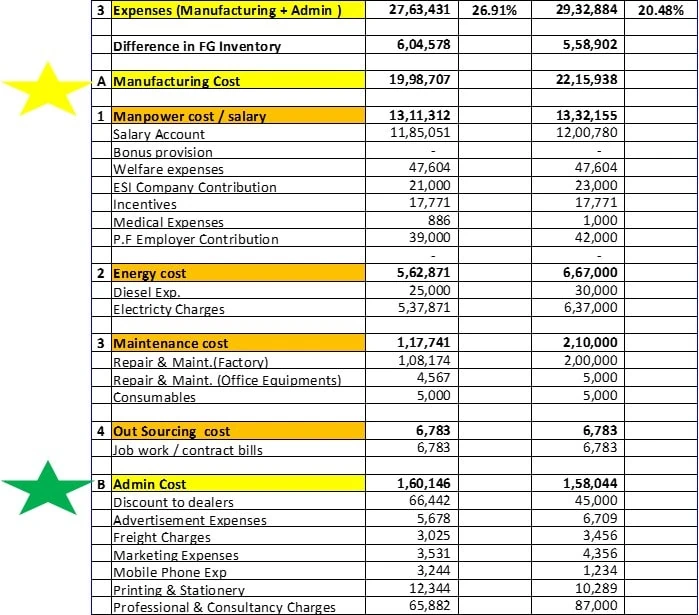

3.Expenses ( Both Manufacturing & Administration expenses):

This part includes expenses other than RM expenses. It includes in two parts, viz direct manufacturing expenses and indirect or administrative expenses.

Depending on the size of the company, some of the manpower expenses are allocated to manufacturing cost and some of the manpower cost to administrative or overhead expenses.

Those expenses can be compared to the sales in terms of Manufacturing Expenses as % of sales and Admin expenses as a % of sales.

The relative comparison against sales in every month will give a clear clarity on the expenses with reference to sales.

4.Operating profitability ( Before Finance, Depreciation and Tax expenses):

This part indicates the real operational effectiveness in terms of OPERATING PROFITABILITY.

This is arrived from the following formulae

Operating Profitability =Sales Revenue- Cost of Material – Cost of Expenses

Cost of expenses include direct and indirect expenses as mentioned above.

Operating profitability is alternatively termed as EBITDA. It stands for Earning before Interest, depreciation and amortization.

As a business head, you should see the effectiveness of your operations with this ” Operating profitability” measure.

This measure is also compared with sales as a % of sales.

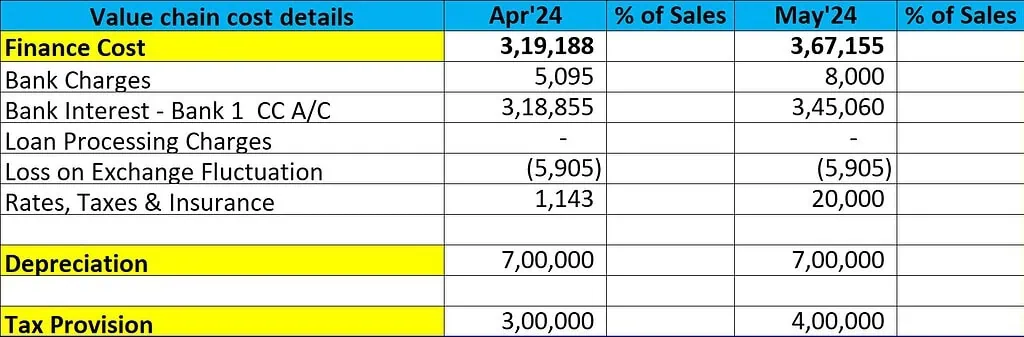

5.Interest / Depreciation and Income Tax provisions :

This part includes interest for the loan to banks and finance institutions and provision for depreciation.

Also, it includes provision for income tax based on the slab your company gets in.

By providing the provisions for all the above expenses, we are rightly arriving the net profitability.

5.Net profitability :

This part shows the overall money you take home after deducting all th expenses by running the business.

Net profitability is very important measure as this show the cash excess / shortage in the system.

It is arrived from the following formula

Net Profitability = Operating profitability- provision for interest, depreciation and income tax

This Net profitability is also compared with sales as a % of sales every month / quarter and this common scale will give a lot of insights for increase / decrease in net profitability.

Why should CEO review P&L EVERY MONTH along with the team?

One of the best management practices that most smart CEOs or business heads use monthly is reviewing the P&L (Profit and Loss) statement and key figures. Some organizations habitually review P&L before the 10th of every month, which helps in other organizational disciplines such as accounting on time, bill collection, and settlement.

Benefits of conducting P&L analysis every month:

- As a business head, it allows you to understand the business profitability, either positive or negative, in the month, giving you more time to take corrective measures in the following months.

- Conducting P&L analysis every month provides insight into your profitable product mix. For example, in one of my client organizations, the team had a high sales turnover in one month compared to the previous month, but the operating margin was lower. Upon analyzing the expenses, there wasn’t much variance between months. However, further analysis of the product mix revealed that the profit margin was low even though more of a particular product, say X, was produced and sold. This kind of analysis gives insight into your product mix, allowing you to optimize it accordingly.

- Analyzing P&L along with the cost variance of each expense encourages the organization’s cost consciousness. This allows you to take countermeasures to control costs. In many of my client organizations, reviewing the P&L every month has led to the organization’s culture moving towards cost consciousness.

Excuses for not conducting P&L analysis every month:

- Some people say the P&L statement may not reflect the real numbers due to variations in inventory accounting, tax provision, and depreciation.

Yes, the monthly P&L statement is notional and only indicative of your operational performance. At the year-end, with all requirements, your auditor will prepare the correct P&L, including accounting principles. This monthly P&L gives you an instant picture of your business performance so that you can take timely action.

Regarding inventory accounting, it will eventually become normalized when done regularly every month. You need to ensure that you use a standard format and input/output mechanism with the same source. For example, if you use TALLY software, use the same source and format/assumptions to prepare a P&L statement every month.

- Lack of discipline in accounting all the bills on time and preparing a P&L statement on time.

Rather than blaming the people and the system, it is the discipline of the business head to show interest in analyzing the P&L every month.

The point is, reviewing P&L analysis is a prime responsibility of the business head and should be done every month to take corrective action on business performance on time!

How your P& L statement review will help you to take right decisions?- Case study examples

In one of clients, they did not have a practice of looking at P&L every month and it used to be done by the Auditor at the end of Financial year for tax filing purpose.

The reason for not doing the P&L analysis was stated as above like aversion to look at the numbers every month and lack of discipline in getting the bills on time.

After introducing the above P&L format and the discipline of reviewing every month, CEO and team had identified that even though the sales volumes were increasing and the expenses were not varying too much against sales value, the net profitability was not increasing.

They identified a root cause that for one of the customers, they delivered more volumes as per demand. However, the critical machine in terms of high machine hour rate was fully utilized. Hence to meet other customer’s requirements, the management had outsourced the high value components to sub contractors which in turn affected their profitability.

Then they took a decision to rationalize the volume vs value in the critical machine which resulted in Net profit improvement from 2 % to 13 % within a month time.

That insight they got when they discussed the P&L during the monthly management review meeting . That is the outcome of doing P&L review every month.

Data speaks powerfully than emotions or opinions!

As a business head, you should drive the culture of data and analysis through P&L review forums.